By Pierre Kelly, age 14, STEM School Chattanooga

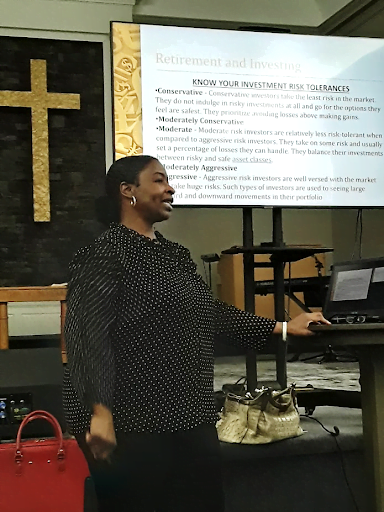

Determine a goal for investing money. Then begin investing, said Frenise Mann, owner of Mann Financial Consulting. No starting amount is too small.

“Don’t think you have to have $1000s to start a type of an account.You can start with $10,” she said. “The more that you put in every month, the more you’re building wealth.”

She spoke this week to more than 40 teens in camp REACH at Hope City Church. The camp promotes literacy using the Lexia reading program and pays students a stipend of up to $150 a week while exposing them to careers in journalism, painting and logistics.

Lurone “Coach” Jennings, executive director of the Mary Walker Foundation which sponsors the camp, said he wants students to learn how to build generational wealth.

Mann has first-hand knowledge of wealth building skills and seeks to share her knowledge with others.

She and her husband, Carlos, were swamped with debt when they married more than 20 years ago. But by following the advice of author and financial guru Dave Ramsey, the two were debt free in six years.

“I know what it means to be without and what it means to have,” said Mann. “I want to teach others, especially in our culture that we can build wealth.”

African Americans come from a slavery background that puts them 200 years behind in the generational gap between blacks and whites. But now blacks have the opportunity to obtain knowledge and wealth like anybody else, she said.

Her latest lesson at Camp REACH showed students how to invest in the stock market.

She awarded candy to teens who correctly answered questions, brightening the mood and making students want to engage more. She taught by asking questions. She first asked about interest rates. Then she explained how interest rates can be used against a student when he owes money, but how compound interest can work for him when he invests.

One teen at the REACH camp after the lecture said, “The finance stuff was very informative and it’s helpful but I feel like at our age we are not going to remember it unless we ask our parents or experience it later in life.”

Mann explained that real estate and investing is a passive means of earning money which means that students can earn money without working eight hours like a job. Students who consistently invest money every month can gain wealth through the effects of compound interest by the time they retire.

Then she listed the steps to open a broker’s account, a custodial account or college fund.

She suggested students go with a custodial company. Mann’s company uses the financial services company, Charles Schwab. She said Fidelity and Vanguard are also good.

Next, determine a goal for investing. The goal may be long-term like saving for college or short-term like purchasing a car when you turn 16, she said.

Then decide how much to invest.

“You can start with $50 or you can start with $25 or you can start with $10, but start,” she said.

Automatically set your brokerage account to take money out of your savings on a monthly basis. Then select a mutual fund or an index fund.

A mutual fund is investing in several stocks. That’s why it’s called mutual, she said.

So a mutual fund means it can have companies like Amazon, Apple and Tesla in one group and buying a share of it means buying a little piece of each company versus buying into just one.

When buying stock in only one company, if that company fails, then all money is lost. But if an investor takes that same money and invests in 20 companies, even if one fails, all the money isn’t lost because the investor still has 19 other companies.

But if a student wants to invest in one single stock, he or she can do that, said Mann.

Her final advice was to set it and forget it. She told students to set up an automatic withdrawal from their income to invest and allow their wealth to accumulate.

“Once you set it up,” she said, “don’t spend it until your goal is met.”

To contact Frenise Mann for financial consulting, call 423-504-5530 or email mannfinancialconsulting@gmail.com